Insurance Programs

Surety Solutions

Risk Management & Safety

“Great Service Cultivates Lasting Relationships” – David Durden (CEO)

Since 1934, Turner Insurance & Bonding Co. has cultivated lasting relationships in the industries we serve through continued emphasis on integrity, service, and expertise. We take pride in ensuring our partners have the foundation necessary to succeed, while always being by their side in times of need.

A Legacy of Partnership & Service

Turner Insurance & Bonding Co. has been serving the insurance and surety needs of our client partners for over nine decades. We are passionately committed to protecting the vital industries we serve which stand as the cornerstones of our communities, the foundations of our infrastructure, and the driving forces behind our economy. Our firm recognizes the inherent risks and challenges faced by those who build our world, and we are dedicated to empowering them with the security and confidence they need to complete each project without hesitation.

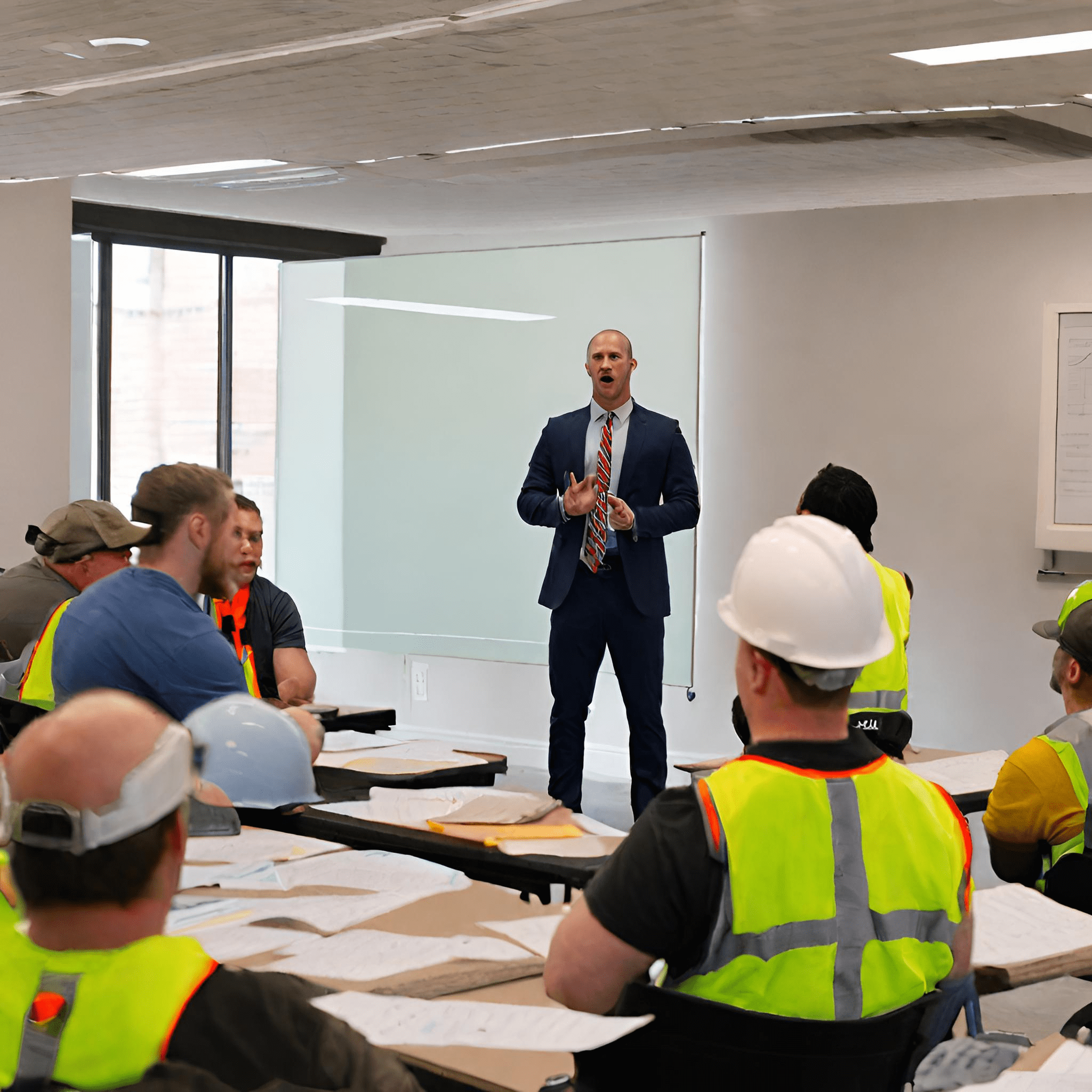

Compliance Webinars

Stay up to date with our monthly webinars and our short and instructional videos that will outline industry updates, coverage issues and concerns, and insight into current events in the insurance, construction, and transportation world.

View Compliance Webinar Library

Testimonials

Caddell Construction Co. has used Turner Insurance & Bonding for over thirty years and they’ve been one of our most trusted partners by providing outstanding service in meeting our insurance and surety needs.

– B.E. (Eddie) Stewart, President